Understanding exactly where your money goes is the foundation of strong financial health, and yet, so many of us struggle with keeping it in check.

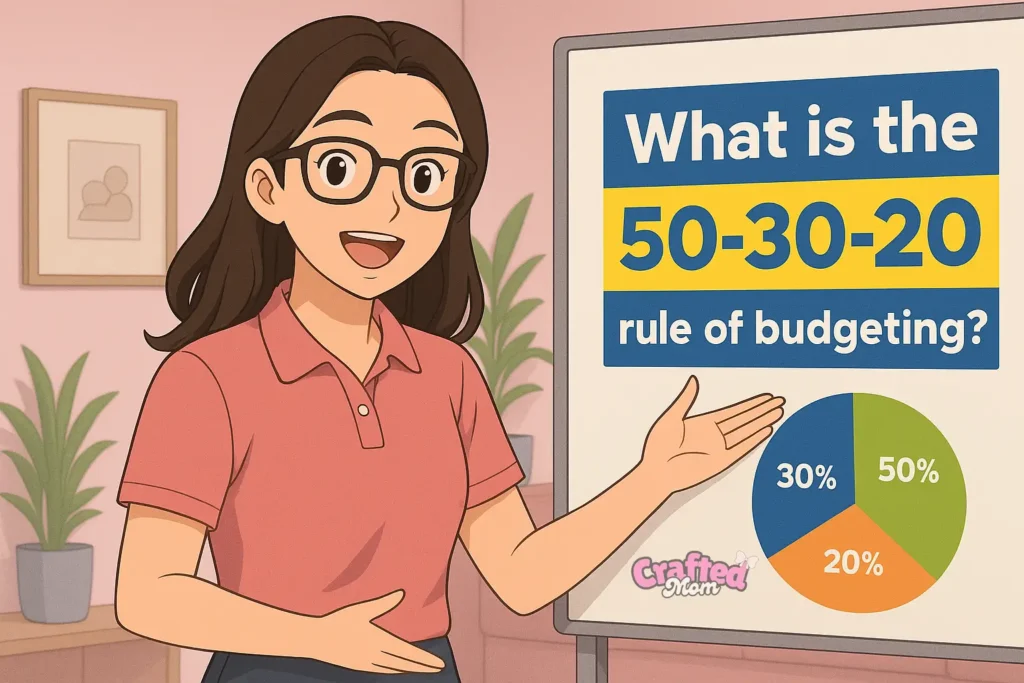

That’s where the 50/30/20 rule comes in. It’s a simple but powerful budgeting method that helps you divide your income into three manageable chunks: essentials, lifestyle fun, and savings.

By balancing these areas, you can enjoy life now while building a secure financial future, no complicated spreadsheets or confusing math required.

How To Manage Your Money

What Is the 50/30/20 Rule?

The 50/30/20 rule is a simple budgeting strategy that splits your net income (what you take home after taxes) into three categories:

- 50% for Needs: Essentials like rent, groceries, utilities, and transportation, things you absolutely must pay.

- 30% for Wants: Non-essentials that make life enjoyable, such as dining out, hobbies, entertainment, and shopping.

- 20% for Savings & Debt Repayment: Money set aside for building your savings, investments, and paying down any debts.

This method helps you balance living comfortably today while preparing for a financially secure tomorrow.

Note: And remember, the 50/30/20 rule is a guide, not a prison sentence. You can tweak the percentages as your life changes, the important part is knowing where your money is going and making those choices on purpose. Once you start telling your dollars where to go instead of wondering where they went, money feels a lot less stressful and a lot more under control.

50% for Needs: Covering the Essentials

This first chunk of the 50/30/20 rule is all about survival and stability. The idea is simple, around half of your take home income goes toward the things you truly have to pay for so your home, health, and basic life stay on track.

Examples of needs:

- Housing: Rent or mortgage payments.

- Utilities: Electricity, water, heating or cooling, and internet.

- Groceries: Food and basic household essentials.

- Health insurance: Any medical coverage that protects you and your family.

- Transportation: Gas, public transit, ride shares, or car payments and insurance.

- Childcare or minimum debt payments: Non negotiable costs that keep kids cared for and debts current.

Key point,

Needs are the must haves. You cannot easily cut them without shaking up your whole life, which is why keeping them around that 50 percent mark helps your budget stay balanced.

30% for Wants: Enhancing Your Lifestyle

Examples of Wants

Wants are the fun and enjoyable expenses that aren’t essential, but they definitely add spice to your life:

- Dining out: Meals at restaurants, cafes, or takeout.

- Shopping for non-essentials: Clothes, gadgets, and other items you want but don’t need.

- Subscriptions: Streaming services like Netflix, Hulu, Spotify, or gaming memberships.

- Travel and Vacations: That well-deserved getaway or weekend trips.

- Hobbies and Entertainment: Concerts, movies, sports, or classes.

Key Point

While wants aren’t essential, they play a big role in your quality of life. Just be careful not to mix them up with needs when budgeting!

Quick gut check to tell a want from a need:

- If you can delay it a month and your life is basically the same, it is probably a want.

- If skipping it would affect your safety, housing, health, or ability to work, it is a need.

- If it started as a treat but now shows up on autopay, double check that it still fits your 30 percent.

That way, you still make plenty of room for joy, but you keep your lifestyle upgrades from quietly swallowing your whole budget.

20% for Savings & Debt Repayment

Examples of Savings Goals

This portion is all about building your financial safety net and future wealth:

- Emergency fund: Enough cash to cover 6 to 12 months of living expenses for unexpected events.

- Retirement accounts: Contributions to your 401(k), IRA, or other retirement plans.

- Investment accounts: Money put aside for growth and long-term goals.

Examples of Debt Repayment

Reducing debt is equally important and helps free up future cash flow:

- Paying down credit card balances.

- Making regular payments on student loans.

- Tackling personal loans or any other outstanding debts.

Key Point

Allocating this 20% ensures you’re protecting your future while keeping debt under control, helping you avoid financial pitfalls.

How to make this 20% stick:

Set it up on autopilot. Schedule transfers to savings and debt right after payday so you are not tempted to spend it first. Start smaller if you need to, even 5 to 10 percent is better than nothing, and work your way up to the full 20 percent. Celebrate every balance that goes down and every savings number that goes up, those tiny wins are what quietly change your whole financial future.

Why This Rule Works

The 50/30/20 rule works so well because it is simple enough to actually use in real life, even on a busy, messy Tuesday with kids yelling in the background. You do not need fancy apps or a finance degree, just your take home income and a calculator.

Here is why it is so powerful,

- It is easy to follow:

You only have three buckets to think about,- 50 percent for needs.

- 30 percent for wants.

- 20 percent for savings and debt.

That simplicity makes it perfect if you are new to budgeting or tired of complicated systems.

- It protects your essentials and your joy:

- Your must haves, housing, food, bills, are covered first.

- You still get a clear, guilt free space for fun and lifestyle upgrades So you are not living in constant restriction mode.

- It builds long term habits:

- Saving and debt repayment become a built in, automatic part of your plan.

- You practice paying yourself first every month Over time, that consistency is what creates real financial security and peace of mind, not random “good months” here and there.

Common Pitfalls to Avoid

Even with a simple system like the 50/30/20 rule, there are a few sneaky traps that can throw your whole budget off without you noticing. Here is what I try to watch for in my own money routine,

- Letting wants sneak into the needs category

It is so easy to convince yourself that daily lattes, constant takeout, or extra streaming apps are “needs.” They are not.- Needs keep you housed, fed, insured, and able to work.

- Wants are upgrades, nice to have, not survival Keeping that line clear is what keeps your budget honest.

- Using gross income instead of net

The 50/30/20 rule is based on your take home pay, not the big number at the top of your contract.- Look at what actually lands in your bank after taxes and deductions.

- Build your percentages from that number only If you budget from gross, everything will feel tight and “off.”

- Skipping emergency savings “for now”

It is tempting to say, “I will save later, once things calm down,” but life rarely calms down.- Aim to build at least a starter emergency fund, even a small cushion helps.

- Treat it like a bill to future you, not an optional extra Without it, one surprise bill can wreck months of good habits.

- Not tracking real spending over time

If you never check where your money actually goes, your budget is just a cute idea on paper.- Track expenses for at least a month, every swipe and cash purchase.

- Compare your real numbers to your 50, 30, and 20 percent targets That is how you catch overspending early and gently adjust instead of panicking later.

Final Thoughts: Track, Adjust, and Succeed

- Create a simple monthly budget spreadsheet to keep all your income and expenses organized.

- Regularly review your spending habits to see what’s working and where you might need to tighten up.

- Be flexible, adjust your budget categories as your life changes, whether that’s a new job, moving, or other big shifts.

- Finally, share this budgeting method with friends and family. Helping others master their money can boost your own financial confidence and success too.

Takeaway: Simplicity Is the Key to Financial Success

I really believe this, until you write it down, you will not realize where your money is actually going. It feels like “I only grabbed coffee and a few things on sale,” then you see the totals and go, oh. Sometimes the smallest, most boring habits are the ones that quietly change everything.

Here is how to keep it simple and powerful,

- Pick one tracking method, notebook, spreadsheet, budgeting app, do not overcomplicate it.

- Write down every expense for at least 30 days, even the tiny ones.

- Review once a week, not to judge yourself, just to notice patterns.

- Highlight anything that surprised you, eating out, subscriptions, “little” impulse buys.

- Choose one small change to try next week, not ten, one.

Start tracking, stay consistent, and your financial confidence will grow way faster than you expect.

Frequently Asked Questions:

What is the 60/30/10 rule for money management?

It’s a budgeting method where 60% goes to needs, 30% to wants, and 10% to savings or debt repayment.

Is the 60/30/10 rule better than the 50/30/20 rule?

It depends on your goals. The 60/30/10 rule prioritizes essentials more, which may help if your cost of living is higher.

Can I adjust the 60/30/10 rule to fit my income?

Yes, the rule is flexible, just keep the core structure and tweak the percentages based on your financial priorities.